Which of the Following Bonds Has the Greatest Price Risk

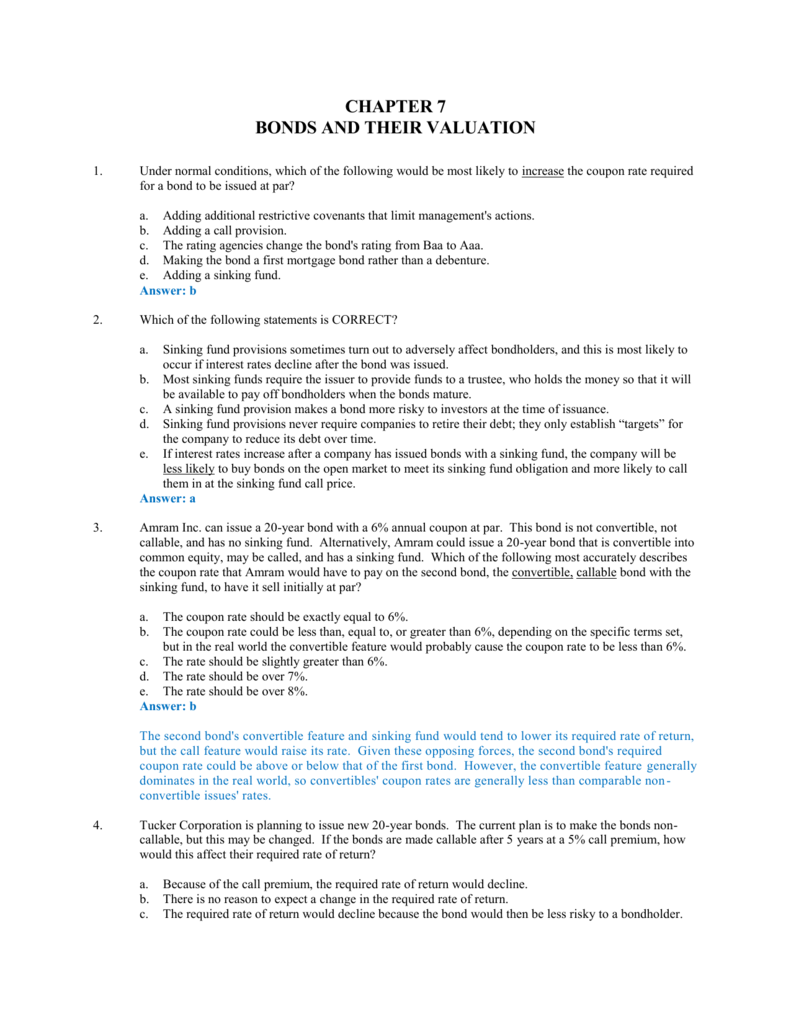

All 10-year bonds have the. A 10-year 1000 face value 10 coupon bond with semiannual interest payments.

All 10-year bonds have the same price risk since they have the same maturity.

. Long-term bonds have less price risk but more reinvestment risk than short-term bonds. Long-term bonds have less price risk but more reinvestment risk than short-term bonds. A 10-year 100 annuity.

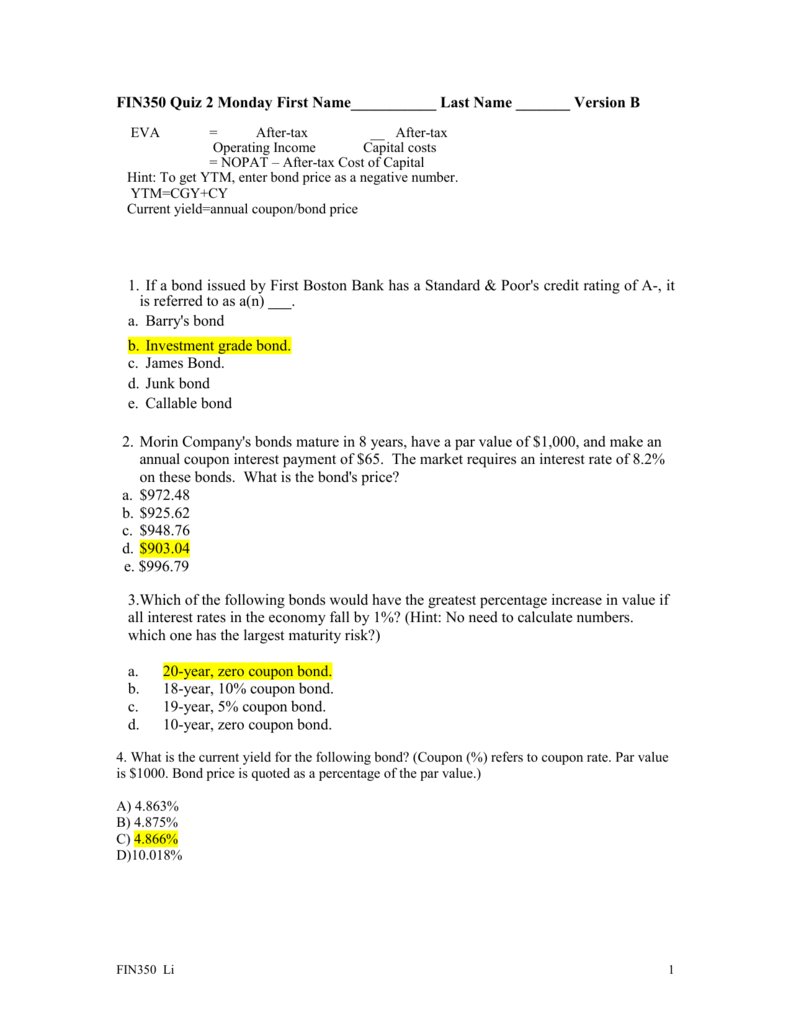

Which of the following bonds has the greatest interest rate price risk. A 10-year 1000 face value 10 coupon bond with annual interest payments. A 10-year 1000 face value zero coupon bond.

Which of the following bonds has the greatest price risk. The bond with the most interest-rate risk or price volatility is the one with the longest maturity and lowest coupon. A A bond maturing in five years.

A 10-year 1000 face value 10 coupon bond with annual interest payments. All 10-year bonds have the same price risk since they have the same maturity. A 10 - year 1000 face value zero coupon bond.

A 10-year 100 annuity. Which of the following bonds has the greatest price risk. All 10-year bonds have the.

B A bond maturing in 20 years. Which of the following bonds has the greatest price risk. Which of the following bonds has the greatest interest rate price risk.

See the answer See the answer done loading. B A 10-year 1000 face value zero coupon bond. C A 10-year 1000 face value 10 coupon bond with annual interest payments.

January 27 2022 by sarah yalton. A 10-year 1000 face value 10 coupon bond with annual interest payments. A 10-year 1000 face value zero coupon bond.

Assume the bonds have the same face value A. A 10-year 1000 face value zero coupon bond. If interest rates increase all bond prices will increase but the increase will be greater for bonds that have less price risk.

6-year zero coupon bond D. Heya mate The answer of ur question is A 10 year 10 coupon bond has the greatest interest rate price risk hope it helps. 6 Which of the following bonds has the greatest interest rate price risk a A 10 from FIN 103 at Ateneo de Manila University.

1 vs 8 10 or 80 paid out. If there is a decline in interest rates you would rather be holding long-term bonds because their price would increase more than the price of the short-term bonds giving them a higher return. A 10-year 1000 face value 10 coupon bond with annual interest payments.

All 10-year bonds have the. All 10-year bonds have the same price risk since they have the same maturitye. Which of the following bonds has the greatest price risk.

The lowest coupon bond has the most price risk. Long-term bonds have less price risk and also less reinvestment risk than short-term bonds. A 10-year 100 annuity.

The primary purpose of life insurance is to provide. Relative to a coupon-bearing bond with the same maturity a zero coupon bond has more price risk but less reinvestment risk. A Safe investment avenue.

Which of the following bonds has the greatest price risk. A 10-year 1000 face value zero coupon bond. A 10-year 1000 face value zero coupon bond.

A 10-year 1000 face value 10 coupon bond with annual interest payments. However long-term bonds have a greater interest-rate risk. A 10 year 5 coupon bond has the greatest interest rate price risk.

Analyst Bank Clerk Bank PO. A 10-year 1000 face value zero coupon bond. If interest rates increase all bond prices will increase but the increase will be greater for bonds that have less price risk.

Which of the following bonds has the greatest interest rate price risk. AIEEE Bank Exams CAT. Accounts Payable - Accounting and Finance.

A 10-year 1000 face value 10 coupon bond with semiannual interest payments. Reinvestment risk include a decline in interest rate leading a rise in prices. - For All Answers.

A a 10 year 5 coupon bond. Up to 25 cash back Which of the following bonds has the greatest interest rate price risk. D All 10-year bonds have the same price risk since they have the same maturity.

A A 10-year 100 annuity. All 10-year bonds have the same price risk since they have the same maturity. 10-year bond with coupon rate of 5 percent.

6-year bond with coupon rate of 5 percent C. A 10-year 1000 face value zero coupon bond. Which of the following bonds has the GREATEST price risk.

D A bond maturing in 15 years. All 10-year bonds have the same price risk since they have the same maturity. A 10-year 100 annuity.

A 10-year 100 annuity. A 10-year 1000 face value 10 coupon bond with annual interest payments. A 10-year 1000 face value 10 coupon bond with annual interest payments.

16-year zero coupon bond E. C A bond maturing in 10 years. Which of the following bonds has the greatest interest rate price risk.

16-year bond with coupon rate of 5 percent B. Because the short-term interest rate are much more volatile than long-term rates you would in the real world generally be subject to much more price risk if you purchased a 30-day bond than if you bought a 30-year bond. Which of the following bonds has the greatest price risk.

A 10-year 100 annuity. A 10-year 100 annuity. A 10-year 1000 face value 10 coupon bond with annual interest payments.

A 10-year 100 annuity. A 10-year 1000 face value 10 coupon bond with annual interest payments. A 10-year 1000 face value 10 coupon bond with semiannual interest payments.

B A bond maturing in 20 years. The cash flow of bonds will go into new issues with a lower yield. Which of the following bonds has the greatest interest rate price risk.

Relative to a coupon-bearing bond with the same maturity a zero coupon. A 12-year bond has an annual coupon of 9. Since bonds are redeemed when interest rates begin to fall bonds has vulnerable to reinvestment risk.

Finance questions and answers. All 10-year bonds have the same price risk since they have the same maturity. And this answer really depends on the duration of the bonds not just there term to maturity.

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Napkins Napkin Finance Finance Investing Investing Finance

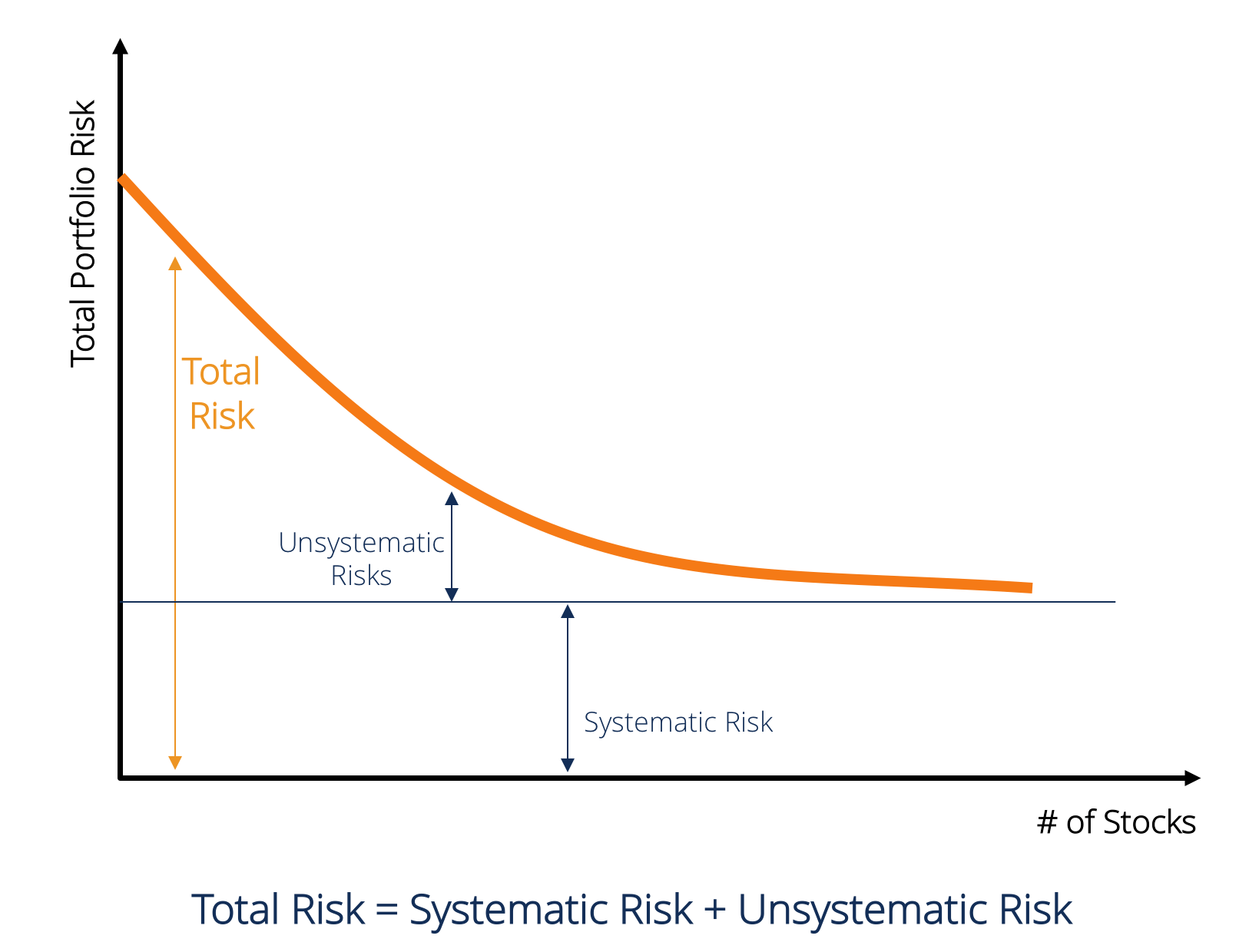

Systematic Risk Learn How To Identify And Calculate Systematic Risk

Understanding Bond Prices And Yields

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png)

Corporate Bonds An Introduction To Credit Risk

Goldman Sachs Greatest Opponents Goldman Sachs Investment Banking Investing

The Financial Workout On Instagram Stocks Vs Bonds Stocksvsbonds Financialinstruments Financialsecurities In 2021 Financial Investments Financial Stock Market

Understanding Interest Rate Risk And How You Can Manage It American Century Investments

Volatility Of Bond Prices In The Secondary Market

Financial Risk Pyramid Speculative Investment Tools Increasing Potential For Higher Returns Increasing Risk Saving Investment Tools Investing Finance Investing

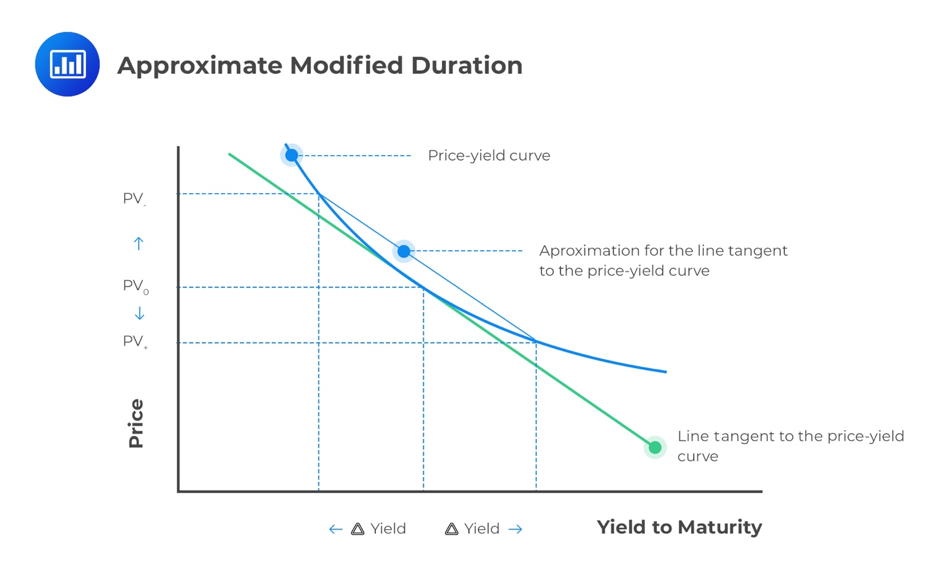

Macaulay Modified And Effective Durations Cfa Program Level 1 Analystprep

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Duration And Convexity To Measure Bond Risk

Interview With Dr Ted Naiman The P E Diet Book Leverage Your Body To Achieve Optimal Health Ketogains Diet Books Protein Energy Energy Diet

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

Comments

Post a Comment